![Placeholder: [Burroughs' collage style] Value at Risk (VaR): Utilizes Parametric VaR, Historical Simulation, and Monte Carlo Simulation to quantify potential portfolio losses. Risk Management: Employs CreditRisk models, KMV models for credit risk, and stress testing to evaluate adverse scenarios. Modern Portfolio Theory (MPT): Involves Mean-Variance Optimization, Efficient Frontier, and Capital Asset Pricing Model (CAPM) for optimal asset allocation. Risk Analysis: Utilizes Factor Models (like Fama-French),](https://img.stablecog.com/insecure/64w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vYTkyM2I1NzktOGVlNi00YjQ5LTkwMjktNGZmODdjMGY5NjM5LmpwZWc.webp)

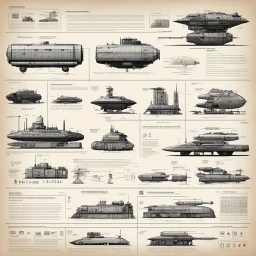

![[Burroughs' collage style] Value at Risk (VaR): Utilizes Parametric VaR, Historical Simulation, and Monte Carlo Simulation to quantify potential portfolio losses. Risk Management: Employs CreditRisk models, KMV models for credit risk, and stress testing to evaluate adverse scenarios. Modern Portfolio Theory (MPT): Involves Mean-Variance Optimization, Efficient Frontier, and Capital Asset Pricing Model (CAPM) for optimal asset allocation. Risk Analysis: Utilizes Factor Models (like Fama-French),](https://img.stablecog.com/insecure/1920w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vYTkyM2I1NzktOGVlNi00YjQ5LTkwMjktNGZmODdjMGY5NjM5LmpwZWc.webp)

@generalpha

Prompt

[Burroughs' collage style] Value at Risk (VaR): Utilizes Parametric VaR, Historical Simulation, and Monte Carlo Simulation to quantify potential portfolio losses. Risk Management: Employs CreditRisk models, KMV models for credit risk, and stress testing to evaluate adverse scenarios. Modern Portfolio Theory (MPT): Involves Mean-Variance Optimization, Efficient Frontier, and Capital Asset Pricing Model (CAPM) for optimal asset allocation. Risk Analysis: Utilizes Factor Models (like Fama-French),

statue, doubles, twins, entangled fingers, Worst Quality, ugly, ugly face, watermarks, undetailed, unrealistic, double limbs, worst hands, worst body, Disfigured, double, twin, dialog, book, multiple fingers, deformed, deformity, ugliness, poorly drawn face, extra_limb, extra limbs, bad hands, wrong hands, poorly drawn hands, messy drawing, cropped head, bad anatomy, lowres, extra digit, fewer digit, worst quality, low quality, jpeg artifacts, watermark, missing fingers, cropped, poorly drawn

1 year ago

Model

SSD-1B

Guidance Scale

7

Dimensions

1024 × 1024

![[woman, diagram] the principal may find it challenging to effectively monitor and control the agent's actions. The agent may engage in hidden actions or manipulate information, making it difficult for the principal to assess the agent's performance accurately. Lastly, the principal-agent problem can also be exacerbated by diverging risk preferences. The principal may be risk-averse, seeking to minimize potential losses, while the agent may be more risk-seeking, pursuing opportunities that offer](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMjQzNjZiNDEtZTgwNS00NDAyLWFkZmItMTcyMjU0MTdkZjdiLmpwZWc.webp)

![[in outer space with celestial objects by Rogelio Bernal Andreo] Creating an origami satellite made of newspapers? Now that's a challenge. Imagine folding the newspaper pages with precision, forming intricate creases to mold the shape of a satellite floating in space. The black and white print of the newspaper adds a unique texture to the origami creation, giving it a rustic and artistic look. The satellite's solar panels delicately crafted from news headlines, its antennas made from classified](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vNmJiZmE4MDgtZmIzMi00ZGRjLThjNGItOTI0YTUxMWM5NWI5LmpwZWc.webp)

![character concept sheet with AD&D statistics and characteristics, [wii No More Heroes style with thick lines] Conan the barbarian on the throne with all his iconic glory](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMzJjZGEzNTktOTU4ZS00MzM1LWI3ZGUtMzZkNmU3NDNkZDg5LmpwZWc.webp)

![[woman, diagram] the principal may find it challenging to effectively monitor and control the agent's actions. The agent may engage in hidden actions or manipulate information, making it difficult for the principal to assess the agent's performance accurately. Lastly, the principal-agent problem can also be exacerbated by diverging risk preferences. The principal may be risk-averse, seeking to minimize potential losses, while the agent may be more risk-seeking, pursuing opportunities that offer](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMjYyMGI5YzctMDExMy00NTAzLTgyY2EtM2YxN2NmNzgyNTBkLmpwZWc.webp)

![character concept sheet with AD&D statistics and characteristics, [illustration by Norman Rockwell] Witchfinder Sergeant](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vNzBkYjRkYTQtOTRmYy00M2I0LWE4ZjQtZmU5NzAyNjlkZGZiLmpwZWc.webp)

![[in outer space with celestial objects by Rogelio Bernal Andreo] Creating an origami satellite made of newspapers? Now that's a challenge. Imagine folding the newspaper pages with precision, forming intricate creases to mold the shape of a satellite floating in space. The black and white print of the newspaper adds a unique texture to the origami creation, giving it a rustic and artistic look. The satellite's solar panels delicately crafted from news headlines, its antennas made from classified](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vYjFmNzAxMTgtNWEzMy00YWYyLTg5MGItODA4NGViZDY0OTJmLmpwZWc.webp)

![[Burroughs' collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testing Models ARIMA (AutoRegressive I](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMTIwZDljZTgtNjBlMi00ODI0LTljZTktOGVkMTYxNDhhYjlkLmpwZWc.webp)

![character concept sheet with AD&D statistics and characteristics, [high res photo by Norman Rockwell for Bushido] a female medieval warrior adopt a position close to the Japanese Mahami No Nekoashi Dachi (Kokutso Dachi), moving to squat with legs bent, stretching out his arms, one forward with his sword, the other backward, so that the lower part of his body with the folds of his combat robe resembles a fan turned downward](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vZWE2YjBkMWQtYTBjMy00ZjQ1LWIyZjAtNzcxNTA1MzdhMWJkLmpwZWc.webp)

![character concept sheet with AD&D statistics and characteristics, [wii No More Heroes style with thick lines] Conan the barbarian on the throne with all his iconic glory](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMGFhYzE5YmYtNzdiYS00ZGI3LThlNTctMWRjMmQ4ZWQ0MDRiLmpwZWc.webp)