![Placeholder: [Burroughs' collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testing Models ARIMA (AutoRegressive I](https://img.stablecog.com/insecure/64w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMTIwZDljZTgtNjBlMi00ODI0LTljZTktOGVkMTYxNDhhYjlkLmpwZWc.webp)

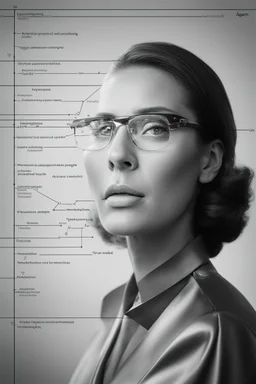

![[Burroughs' collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testing Models ARIMA (AutoRegressive I](https://img.stablecog.com/insecure/1920w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMTIwZDljZTgtNjBlMi00ODI0LTljZTktOGVkMTYxNDhhYjlkLmpwZWc.webp)

@generalpha

Prompt

[Burroughs' collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testing Models ARIMA (AutoRegressive I

statue, doubles, twins, entangled fingers, Worst Quality, ugly, ugly face, watermarks, undetailed, unrealistic, double limbs, worst hands, worst body, Disfigured, double, twin, dialog, book, multiple fingers, deformed, deformity, ugliness, poorly drawn face, extra_limb, extra limbs, bad hands, wrong hands, poorly drawn hands, messy drawing, cropped head, bad anatomy, lowres, extra digit, fewer digit, worst quality, low quality, jpeg artifacts, watermark, missing fingers, cropped, poorly drawn

1 year ago

Model

SSD-1B

Guidance Scale

7

Dimensions

1024 × 1024

![[Burroughs' coloured galleries of portraits collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testin](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vZmVhY2U3YTgtNjMzMi00OGEwLWIzZGMtOTdmY2QxODZmNzlkLmpwZWc.webp)

![[no one] A glitchy video message on a smartphone screen, with fragmented words and disjointed images, symbolizing the call to adventure.the screen, a mix of curiosity and unease . [William S. Burroughs' "The Electronic Revolution" and Jack Kerouac's "On the Road." ]](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vNTVlOGVkODktOGE3Ny00ZjI0LTgwYTQtYTIxMzEyZTk2ZDIxLmpwZWc.webp)

![[shades of white and gradient of grays hairstyle] Andy Warhol, the legendary artist known for his iconic silver-white hair and avant-garde style. His distinctive hairstyle became a symbol of his artistic persona. A colour high res photo by Helmut Newton in his atelier in front of a white monochrome](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vNjI2NWI1NjMtMWRmMy00N2ZlLTllMTYtYjE5YjRmMDZkZjkxLmpwZWc.webp)

![[a man and a woman] A glitchy video message on a smartphone screen, with fragmented words and disjointed images, symbolizing the call to adventure.The protagonists staring at the screen, a mix of curiosity and unease on their face. [William S. Burroughs' "The Electronic Revolution" and Jack Kerouac's "On the Road." ]](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vYmMwODk3NjgtMzExYS00MTMyLTkwMDgtNDQ4MzFhNDQ2NjU4LmpwZWc.webp)

![[kupka's coloured galleries of portraits collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress Testin](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMmVkOWY4NjItOTUzMi00MTIwLTliYmEtMDMxYWNjMzE3YmM4LmpwZWc.webp)

![[Burroughs' collage style] Value at Risk (VaR): Utilizes Parametric VaR, Historical Simulation, and Monte Carlo Simulation to quantify potential portfolio losses. Risk Management: Employs CreditRisk models, KMV models for credit risk, and stress testing to evaluate adverse scenarios. Modern Portfolio Theory (MPT): Involves Mean-Variance Optimization, Efficient Frontier, and Capital Asset Pricing Model (CAPM) for optimal asset allocation. Risk Analysis: Utilizes Factor Models (like Fama-French),](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vYTkyM2I1NzktOGVlNi00YjQ5LTkwMjktNGZmODdjMGY5NjM5LmpwZWc.webp)

![[woman] The principal-agent problem is a concept that extends beyond traditional business and political relationships. It can also be observed in strategic games like chess, where players act as both principals and agents. In chess, the principal-agent problem arises when players must make decisions on behalf of their long-term goals while considering immediate tactical advantages. The conflict arises when an agent prioritizes short-term gains, deviating from the optimal long-term strategy desir](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vNjY4NTdhNzEtNzFiMy00ZWQzLTgxYjItZDk5NzI2YThlYTAyLmpwZWc.webp)

![[kupka's coloured galleries of maths portraits collage style, women in mathematics] Parametric VaR Historical Simulation Monte Carlo Simulation Modern Portfolio Theory (MPT) Capital Asset Pricing Model (CAPM) Arbitrage Pricing Theory (APT) Black-Litterman Model Black-Scholes Model Binomial Options Pricing Model Cox-Ross-Rubinstein Model Heston Model (stochastic volatility) Vasicek Model Hull-White Model Cox-Ingersoll-Ross Model Heath-Jarrow-Morton Framework CreditRisk+ Model KMV Model Stress](https://img.stablecog.com/insecure/256w/aHR0cHM6Ly9iLnN0YWJsZWNvZy5jb20vMWZhMGJhNTgtOWM2MS00N2FiLWEzYTUtMDBkOGZhZTg2NzE2LmpwZWc.webp)